Futures Margin Explained: Initial vs Maintenance Margin for Prop Firm Traders

9/3/2025, 7:09:35 AM

Initial vs maintenance margin in prop firm futures trading: master leverage, capital efficiency, and risk controls to stay funded in leveraged markets.

When trading with futures prop firms, the most important thing is to utilize the firm's resources efficiently and manage risk effectively. This has a significant impact on the margin level, as you must determine the level required to open a position and how much you must maintain to avoid having your position liquidated. The great thing about futures is that they let you manage large positions with a small account. Understanding how margin works is key to scaling positions, avoiding margin calls, and achieving success.

Next, we present a simple guide to help you understand the purpose, the differences between initial and maintenance margin, and the strategies for effective margin management in futures trading.

FundingTicks is an emerging futures prop firm, offering learning resources and scaling plans to help traders build their careers.

What is Futures Margin?

Margin is a fraction of the full value of the contract that you must maintain to open a position. It exists to ensure your commitment to the contract, just like a security deposit.

This way, you own contracts of large quantities, paying in advance just a small portion instead of the entire price, allowing you to manage large contracts. This is the power of leverage, but you need to use it prudently, or you’ll face a margin call.

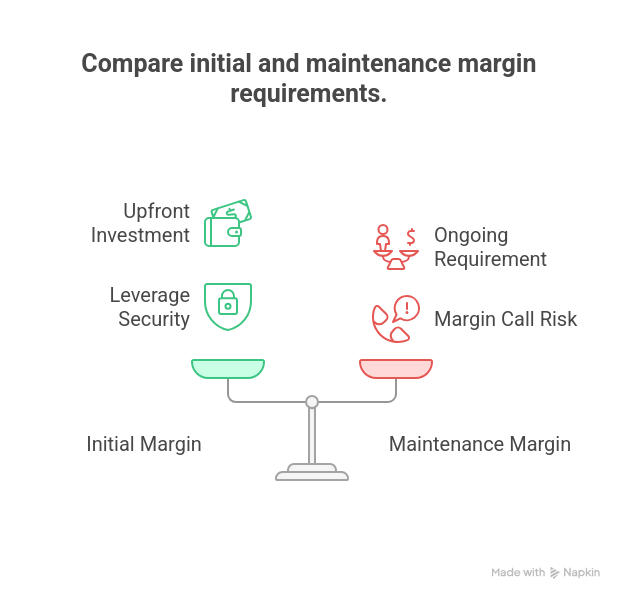

Initial Margin: Your Entry Ticket

Initial margin is the amount of money you must have to open a futures position. Exchanges set a base margin, which reflects the volatility and risk of the contract. In contrast, prop firms impose higher requirements to protect themselves.

For example, trading the E-mini S&P 500 (ES) demands about $12,650 per contract in initial margin on CME Globex. That would secure your leverage and let you manage something like $200,000 of index exposure.

Maintenance Margin: Staying in the Trade

Maintenance margin, on the other hand, is how much money you need to have in your futures account to keep your positions after you have already given the initial margin.

It will be automatically checked daily through the mark-to-market process, where the exchange recalculates gains and losses at the end of each session. If your equity falls below the limit, you will receive a margin call and be required to add more cash to compensate.

Let's say you opened one ES contract with an initial margin of $ 12,650, and its maintenance margin is $10,000. If a downside move of 35 points ($12.50 per tick) puts your equity down to $9,562.50, then you’ll get a margin call. You must always maintain a high standard of maintenance to stay in the trade.

What Happens in a Margin Call?

If your account eventually falls under the level of maintenance, two things could happen: one is that your broker would demand extra money that you need to have at hand, or you would have to auto-liquidate your position to control risk.

Prop firms enforce these calls aggressively, shutting down positions to prioritize saving capital and protect the firm's stability. They layer in buffer thresholds and monitoring, so there’s no grace period once your equity goes down too low.

The best advice to avoid unnecessary problems is always to select trade sizes you can afford, maintain an extra cash reserve in your account, and utilize stop-losses or hedges. Also, remember to check your profit and loss daily and use only the leverage you’re comfortable with.

Margin Calculations in Prop Firms

Prop firms calibrate the risk parameters to keep the positions as safe as possible, setting initial margin above exchange minimums. The idea is always to stop leverage at, say, 10:1 or 20:1, to protect the capital and avoid unnecessary losses.

For example, a $ 100,000 account may only control $1 million in notional value to ensure that drawdowns don’t bring down the firm. When traders handle multiple contracts simultaneously, margin is aggregated across all positions. Therefore, a 3-contract ES and a 2-contract NQ NQ combination would require combined initial and maintenance margins.

Firms continuously track their margin usage, limiting sudden spikes in risk, and adjusting resources as needed to balance both trader ambitions and firm risk.

Strategies for Smart Margin Management

Modern traders focus on minimizing risk, and here are some of the key strategies to manage risk:

Use margin buffers, always trading with extra padding to protect you from any sudden swing in the market.

Watch your P&L every day, looking for any drawdown patterns before they appear and catch you off guard.

Avoid over-leverage when volatility is very high. Wild markets would give you losses faster than gains. Instead, return to your original position size or switch to micro contracts.

Consistent margin buffers, real-time P&L checks, and conservative leverage are your three pillars of margin management.

Comparison Table: Initial vs Maintenance Margin

Here's a basic comparison of the differences between initial and maintenance margin

Type | Purpose | Set By | Triggered When | Example |

Initial | Entry capital requirement | Exchange/Firm | At trade entry | $12,000 for ES |

Maintenance | Minimum to keep trade open | Exchange/Firm | Mark-to-market drop | $10,000 for ES |

Final Thoughts

Mastering initial and maintenance margin is not a suggestion or an option; this is the knowledge you must possess. You must master these concepts and strategies to work with futures contracts effectively. Prop firms expect you to manage margins like a pro. It means sizing your contracts, monitoring P&L, and responding instantly when your buffers start getting too small.

One final piece of advice: memorize your thresholds, consistently plan with worst-case scenarios in mind, and be disciplined with risk control; let it guide your decisions and actions in your trading career.

FundingTicks offers remarkable trading opportunities for future traders without investing their personal capital!